In the second 2 - mortgage principal as of January 1st. In the first one, enter mortgage interest.

The left part provides information about lenders and borrowers: names, addresses, so on The process of the form completion is quite easy and fast, despite the fact it’s pretty long. If you don't receive interest, do not fill out the document. To show an amount of taxes paid during the year įile 1098 is required to fill only if you’re engaged in a trade or business and get $600 or more of hypothec interest. This document is filled out by lenders and issued to borrowers.īlank 1098 is used for reporting to the US government about any kind of information related to lenders, borrowers, or mortgage

IRS Form 1098 is a necessary tax document for filling for those who are preparing to take a mortgage. Instructions for the Requester of Form W-9 In the majority of cases, they will save the filled out document in their records until it is necessary during their annual tax record processing. Just send completed file to the individual or business/financial entity that requests it. The purpose of the tax form W 9 is very clear: it serves to provide your US tax ID (also referred to as Taxpayer Identification Number) to an individual, a bank, or any other financial entity, granting them the possibility to report specific details about you, e.g., the money you've earned from them, certain real estate payment data, interest, etc. Usually, it takes less than 5 minutes to enter needed information because a file already contains all fillable fields. In order to complete template with PDFLiner, you should click the “Fill this form” button to open a blank and follow the instructions below. Here, we added a printable W-9 blank, so you can easily fill it out online, print, send by email, or download. That's where fillable W-9 form comes into play. Internal Revenue Service (IRS) Relevant to W-4 blank form 2022 Documentsįilling out W-9 Form in 2022: Covering the BasicsĪll business entities that order your services have to report that income, as well. Organizations That Work with IRS Form W-4 In case you feel you need help, you can always ask your bookkeeper to do that with you. The editable W4 form is relatively simple to complete without any assistance. Make sure you take your time and complete the form with maximum concentration in mind.

#W4 FORM 2021 UPDATE#

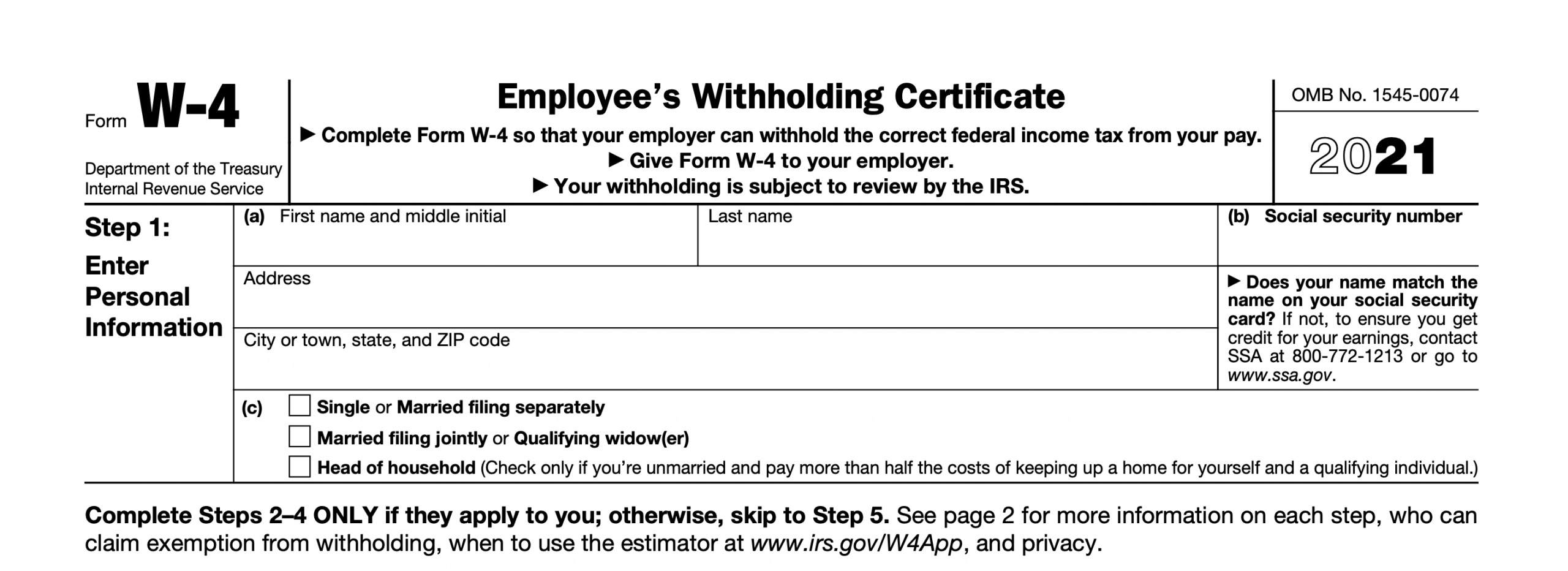

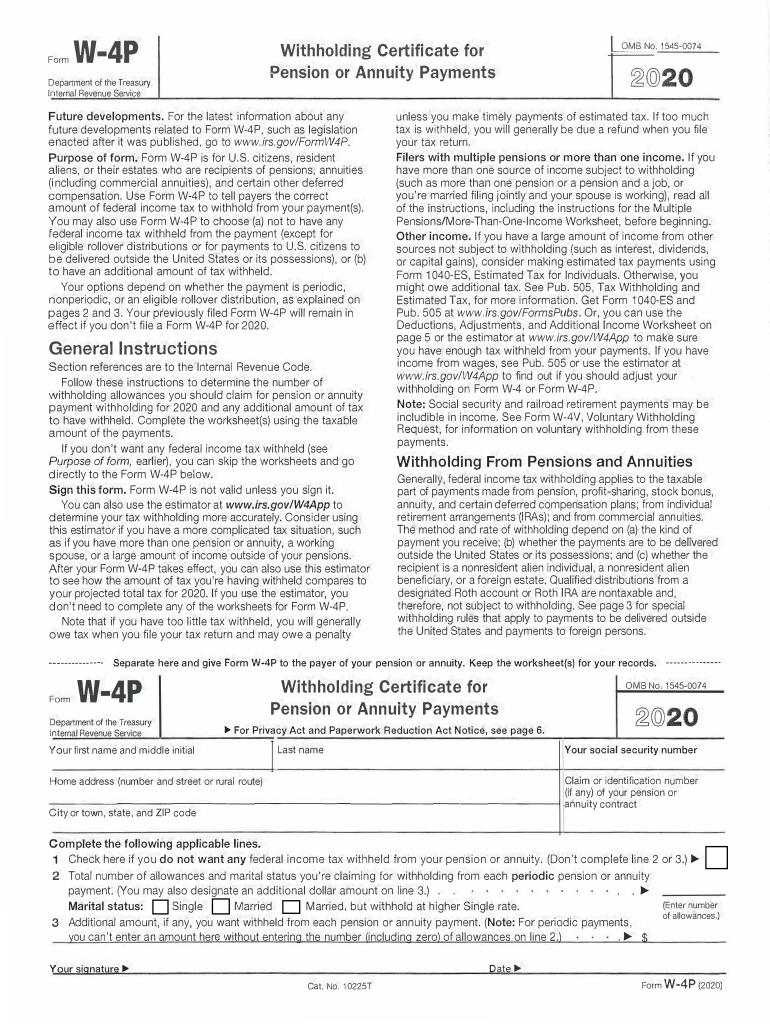

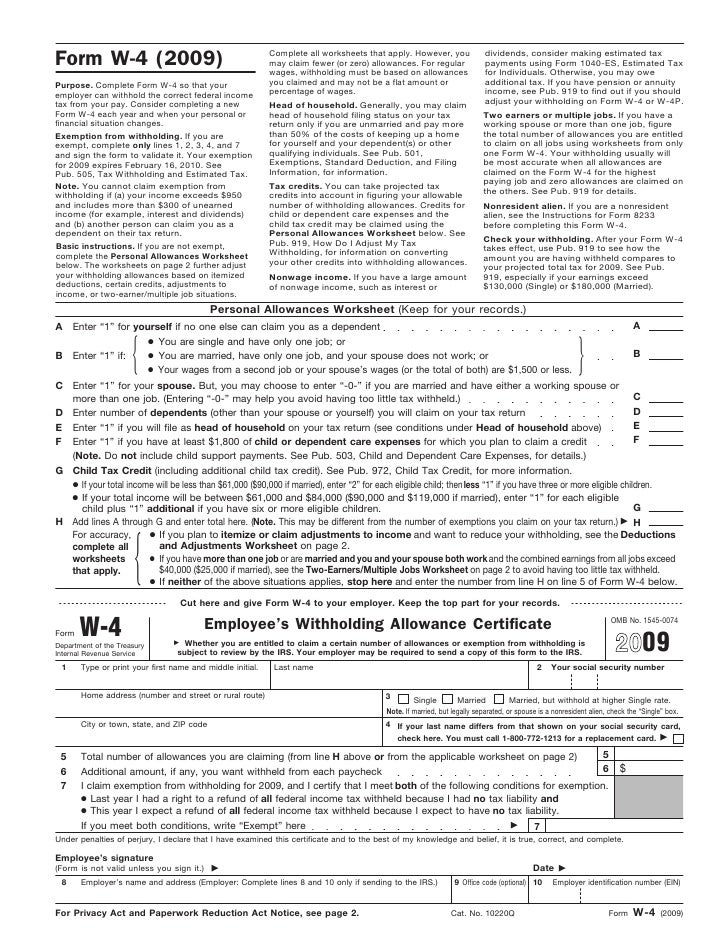

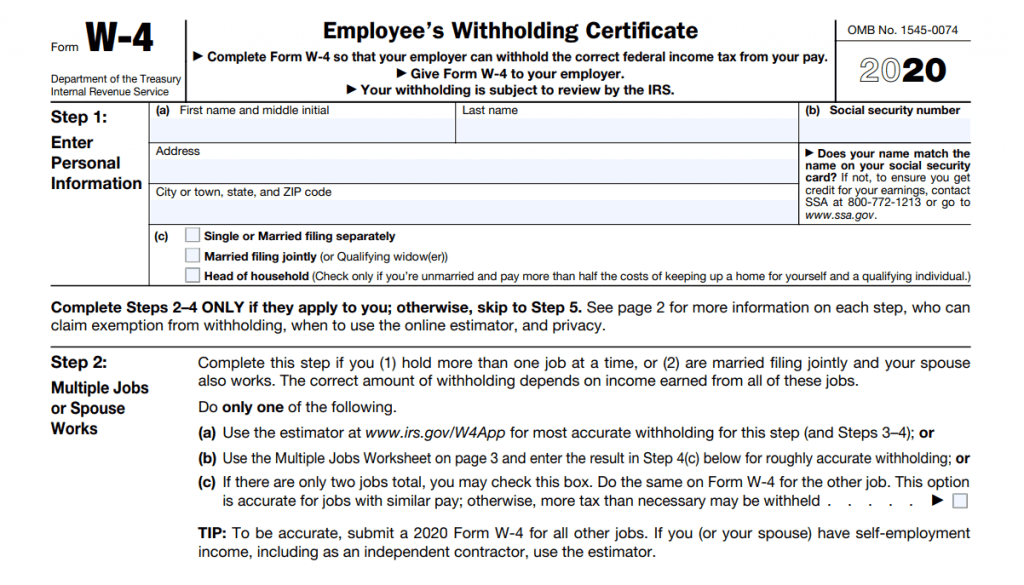

They can also update their W-4 at any time if their personal or financial information changes. If you claim zero allowances on your W-4, the highest amount of taxes will be withheld from your paycheck.Įmployees should complete form W-4 when they start a new job. prevent excessive tightening of your monthly budget.įorm W-4 is completed by employees and is used to calculate the amount of taxes that should be withheld from their paychecks. On the other hand, completing the IRS Form W-4 in a correct way will save you from overpaying your taxes and i.e.The IRS demands us to pay taxes on our income in a gradual manner during the year if you don’t withhold enough tax, the amount of money you could owe to the IRS in April may be way too hefty.Here’s why completing the IRS Form W-4 regularly and accurately is crucial: The form must be submitted on a yearly basis, or whenever your current personal/financial state of affairs changes significantly. The W-4 form is crucial for businesses with employees because the document assists them in taking the right amount of taxes from their employers’ paycheck. The fillable W4 form, formally known as Employee's Withholding Allowance Certificate, is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal income taxes.

0 kommentar(er)

0 kommentar(er)